25 Personal Finance Hacks You’ll Wish You’d Learned Sooner

Do you possess the personality of a successful person? Take This 60 Second Quiz And Get A Personalized Report.

This post is sponsored by Lexington Law, thank you for supporting brands who support TCM. As always, all thoughts, opinions, experiences, and advice are my own.

Honestly, writing this post was a DOOZY! There are SO many personal finances hacks out there. I didn’t want to write you a short novel, so I focused on a well rounded list of general personal finance hacks which I knowww you’ll wish you’d learned sooner! Maybe in the future I’ll do a deeper dive on some more niche posts? Like personal finances hacks for shopping, travel, paying off debt, etc. Would you all like that? Also stay tuned to the bottom of the post where I include some of YOUR tips you messaged me on Instagram!

25 Personal Finance Hacks You’ll Wish You’d Learned Sooner

Personal Finance Hack #1: “Use it up, wear it out, make it do or do without.”

Is a motto for getting out of debt (and living your life) that should become your mantra! It’s a great little financial hack to ensure you’re only buying things you actually need. Put a rule in place you can’t buy a new product of the same category until you’ve used up all your existing product or worn it out completely. This saying gets you in the habit of making do with what you currently have or doing without.

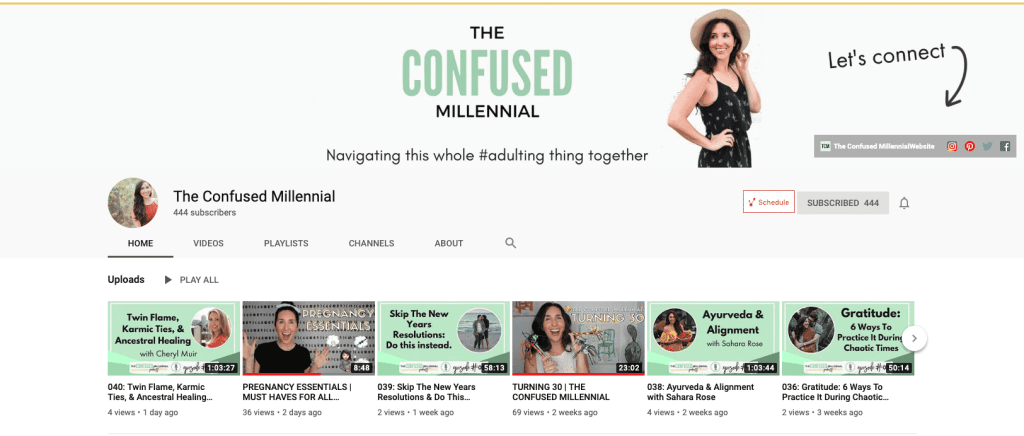

Personal Finance Hack #2: Youtube is your wallets BFF

Youtube is literally your wallets BFF. Don’t want to pay for cable? There’s plentyyyy to watch on Youtube! Even full length 30-60 minute web series that are basically just like TV shows and they have a ton of movies for free. Want to skip the handy man? Youtube has videos that can help you with basic home repairs. Expensive art not an option but still want to create a home that impresses? Youtube has endless ideas for DIYs! Ohh and you can nix the gym membership for at home workouts! They have literally millions to choose from!

Subscribe to my Youtube Channel!

Subscribe to my Youtube Channel!

Personal Finance Hack #3: Regular mindset practice

What do finance hacks and mindset have to do with one another? EVERYTHING! Being able to respect yourself and be disciplined in your financial actions has everything to do with self love. They are the physical manifestation of how much your love yourself. It’s the ultimate form of self care. By getting into a regular mindset practice you can strengthen your resolve to stay committed with your actions.

Personal Finance Hack #4: No-spend challenge

A no-spend challenge is truly my secret weapon in financial hacks. Yes, you will clearly save money if you aren’t spending. But more than that, a no-spend challenge can completely reshape your relationship to money! I went from constantly buying – like shopping sprees every week, sometimes multiple times a week – to learning how to shop with a purpose. I no longer filled a void with my spending, but became intentional. This allowed me to reduce clutter around my house, become more eco-friendly, and watch my wealth grow. Learn more about doing a no-spend challenge here.

Personal Finance Hack #5: Opt for a capsule wardrobe

A capsule wardrobe is when you have 30-50 items that can all be worn together. It’s essentially where every item in your closet is curated and can work together. For instance, you wouldn’t buy that trendy milk maid top just because it’s on trend and would match one other item in your closet; it would need to work with the majority of your closet. Everything is cohesive, so it makes getting dressed a breeze. You can configure the items into tons of different ensembles to keep looking and feeling fresh. It really limits the amount of options when out shopping and helps you put that “use it up, wear it out, make it do or do without” mantra into practice!

Personal Finance Hack #6: Know your “why”

You can read all the personal finance hacks in the world, but that will not help you implement them or make changes to your lifestyle. That’s where knowing your “why” comes in. It’s important to understand why you want to improve your financial situation. Your “why” will act as the motivating factor to keep making the next right choice. Personally, I think it’s also a great idea to do regular check-ins with this since motivation has a half life. You can either revisit it monthly or do regular gratitude lists or come up with your own way of staying connected to it.

Personal Finance Hack #7: Protect your identity

No one wants to be the victim of identity theft. Get ahead of the thieves by protecting your identity. Consider signing up for the Lex OnTrack Identity Theft Protection tool to help you monitor and protect your identity from theft with $1 million in identity theft insurance. Getting your identity stolen takes up a lot of your time and adds loads of stress. Protecting your identity and getting ahead of it is a financial hack that gets overlooked far too often. Personally, I think time is more valuable than money; you can always make more money, you can’t get your time back. You can always make more money, but you can never get your time back. So learn more about protecting your identity using Lex OnTrack here.

Personal Finance Hack #8: Unsubscribe from lists

We are constantly being sold to today and one of the few places we have control over what we see is our inbox. Hit the “unsubscribe” button from all those pesky store emails. Because, let’s be honest, if it’s their biggest sale of the season every single week, is it really ever a sale?

Personal Finance Hack #9: Purchase products in different sections.

Have you heard of the “pink tax?” It’s where brands will mark up items simply because they are pink! Seriously, the exact same pack of razors can be priced differently, solely because one is pink. By opting for the “mens” razors you can save money. The same goes for buying some cosmetic or fashion items from the baby or junior section instead of adult.

Personal Finance Hack #10: Reusable cup for coffee shop discount

BYOC! Bringing your own cup to coffee shops is not only eco-friendly, it can also be wallet friendly! Some coffee shops will offer you a discount on your cup o’ joe for brining your own cup!

Personal Finance Hack #11: Take advantage of birthday rewards

Get in the habit of making up a birthday when signing up for different things. This way you can take advantage of birthday rewards throughout the year! Nothing overwhelms me more than when I get 10 discount offers on my birthday and realize I don’t have the time to take advantage of them if I want to.

Personal Finance Hack #12: Pay yourself first

At the end of the day, your favorite retailer is not here to help you retire! In fact, it’s really on you to ensure you’re covered. So stop giving your hard earned dollars to retailers as soon as payday hits, and start paying yourself first. Getting in the habit of paying yourself first ensures you have the means to reach your financial goals. You’re no longer putting away whatever is left over at the end of the month (because if we’re honest, we know it’s never enough). This shows your worthiness, self respect, and discipline. In fact, there’s a huge movement called the F.I.R.E movement, which stands for: Financial Independence, Retire Early. You can learn more about the F.I.R.E movement and how to get started from Lexington Law here.

Personal Finance Hack #13: Set weekly reminders to check your accounts and pay off balances

Getting into the regular habit of checking all your accounts and paying things off is huge. It may sound like it’s going to take you more time, but chances are it’ll actually save you time. I went from spending an hour each month tracking everything down, to five minutes a week just categorizing, checking, and paying things off. It streamlines the process and saves you time from having to cross check to ensure you’ve made the purchase, find receipts, and pay things off. Plus, it’ll save you money since you should never miss a payment by doing this!

Personal Finance Hack #14: Ask to borrow

This should be what you do for as much as possible in your life! Always ask to borrow from friends, look into the library, etc. before spending money. This is great for both your finances and to reduce environmental waste! A very real issue right now.

Personal Finance Hack #15: Give yourself the gift of an emergency fund

I know I always talk about emergency funds, but they are the corner stone of financial health in my opinion! Next time your birthday or a holiday roll around, ask people to donate to your emergency fund in lieu of a gift. Sure, it’s not the most fun thing, but it is the most stress relieving thing to know you can handle a few thousand dollar emergency if it arises.

Personal Finance Hack #16: Hire professionals

The road to financial freedom does not have to be hard and lonely. In fact, one of my favorite financial hacks is to hire professionals! Whether it’s hiring a cleaning person so you can spend more time on your side hustle or hiring the professionals at Lexington Law to help you repair your credit so you can make financial strides. When you repair your credit you are opening up doors to lower interest rates, paying less on debts, and saving time on avoiding debt collectors or trying to figure out what your financial situation is. Hiring professionals at Lexington Law firm can help you understand your legal rights and options to get your debt under control and repair your credit so you don’t have to waste time feeling anxious and not taking action.

Personal Finance Hack #17: Play with your diet

Meal planning and grocery shopping with a list are two sure fire ways to keep your finances in check. Aside from those, consider going meatless. Even if you don’t want to cut meat from your diet entirely, introduce meatless Monday’s and see how you do. Another option to play around with is to try intermittent fasting which has grown in popularity the last couple of years. Intermittent fasting is when you eat all of your meals for the day in a span of eight hours; which will definitely cut down on your weekly snack budget.

Personal Finance Hack #18: Never buy water

Yes, you want to get your daily dose of H20 in! However, it shouldn’t break the bank. One thing that always makes me cringe when I’m in other people’s homes is bottled water! It’s awful for the environment and a waste of money. Consider installing a whole house water filtration system or getting a water filtering pitcher. If those are out of the question, consider getting the large five gallon water jug for your home. Bottled water is 2,000 times more expensive than tap and less than 30% of it is recycled each year.

Personal Finance Hack #19: Get money back when you spend

Who doesn’t love money back?! There are loads of ways to actually get money back when you spend. Consider installing a browser extension that allows you to get cash back when you shop at certain retailers online. You can also get a cash back rewards credit card. If you’re nervous about opening up a new credit card, make sure you read the fine print before applying. This way you can ensure you’ll get approved before risking the hard inquiry on a rejection. If you need help repairing your credit, get a free consultation with the professionals at Lexington Law Firm here. They specialize in helping people with bad, unfair, unsubstantiated, or inaccurate credit.

Personal Finance Hack #20: Add browser extensions to monitor price drops

There are a handful of great browser extensions you can find today that will monitor items online and email you if the price drops. Even better, some of these extensions will actually email you if you bought an item that has since reduced in price, giving you the chance to save on things you’ve already purchased!

Personal Finance Hack #21: Follow 50/20/30 Guideline

Setting up a budget can feel overwhelming! The 50/20/30 guideline is a really easy, three number budget. Basically it breaks your expenses down into “needs,” “goals,” and “lifestyle.” This can also be a great way to quickly see if you’re overspending in any area. For instance, housing can be one of our largest expenses. The 50/20/30 guideline shows us that if it’s exceeding more than 30% of your income, you’re probably breaking the bank on that “50” number and need to reduce your cost of living! Learn more about the 50/20/30 guideline here.

AND here are the personal finance hacks you all sent in on Instagram:

Personal Finance Hack #22: Use an investing app

These are fantastic! My husband and I have used several over the years and they are a great way to get your feet wet in investing.

Personal Finance Hack #23: Direct deposit to savings

A lot of you messaged in saying you automatically divert a portion of your paycheck to either go directly towards savings or retirement.

Personal Finance Hack #24: Family meetings

A couple of you shared that you do weekly family meetings to make sure everyone is on the same page

Personal Finance Hack #25: Only charge what you can pay off

This is a really smart way and how credit should be utilized (in my opinion)

What personal finance hacks are your favorite? Which do you use most often? Do you want me to do more of these by niche (e.g. a post on personal finance hacks for traveling, for paying off debt, etc.)?

RELATED READS:

How To Be Wealthy In Your 20s or 30s

20 Ways To Save Money On Your Credit Repair Journey

List of 25 Personal Finance Hack You’ll Wish You’d Learned Sooner

-

“Use it up, wear it out, make it do or do without.”

-

Youtube is your wallets BFF

-

Set weekly reminders to check your accounts and pay off balances

-

No-spend challenge

-

Opt for a capsule wardrobe

-

Know your “why”

-

Protect your identity

-

Unsubscribe from lists

-

Purchase products in different sections.

-

Reusable cup for coffee shop discount

-

Birthday rewards

-

Pay yourself first

-

Regular mindset practice

-

Ask to borrow

-

Give yourself the gift of an emergency fund

-

Hire professionals

-

Play with your diet

-

Never buy water

-

Get money back when you spend

-

Add browser extensions to monitor price drops

-

Follow 50/20/30 Guideline

-

Use an investing app

-

Direct deposit to savings

-

Family meetings

-

Only charge what you can pay off

Millennial finances can be a challenge but we must balance our money management with proper diet and exercise. Find out how you can eat your way to a flatter stomach with three unique vegetables and add to your arsenal of overall health and wellness.

Learn The 7 Laws of Wealth Attraction in this free ebook

Comments

Post a Comment